Proactively supporting business

Bridge Enterprise Centres proactively support people and organisations as they learn about and develop enterprise activities. Keep up to date with developments at Bridge Enterprise Centres and our latest member news, insights and events.

- All

- Bridge Updates

- Events

- Insights

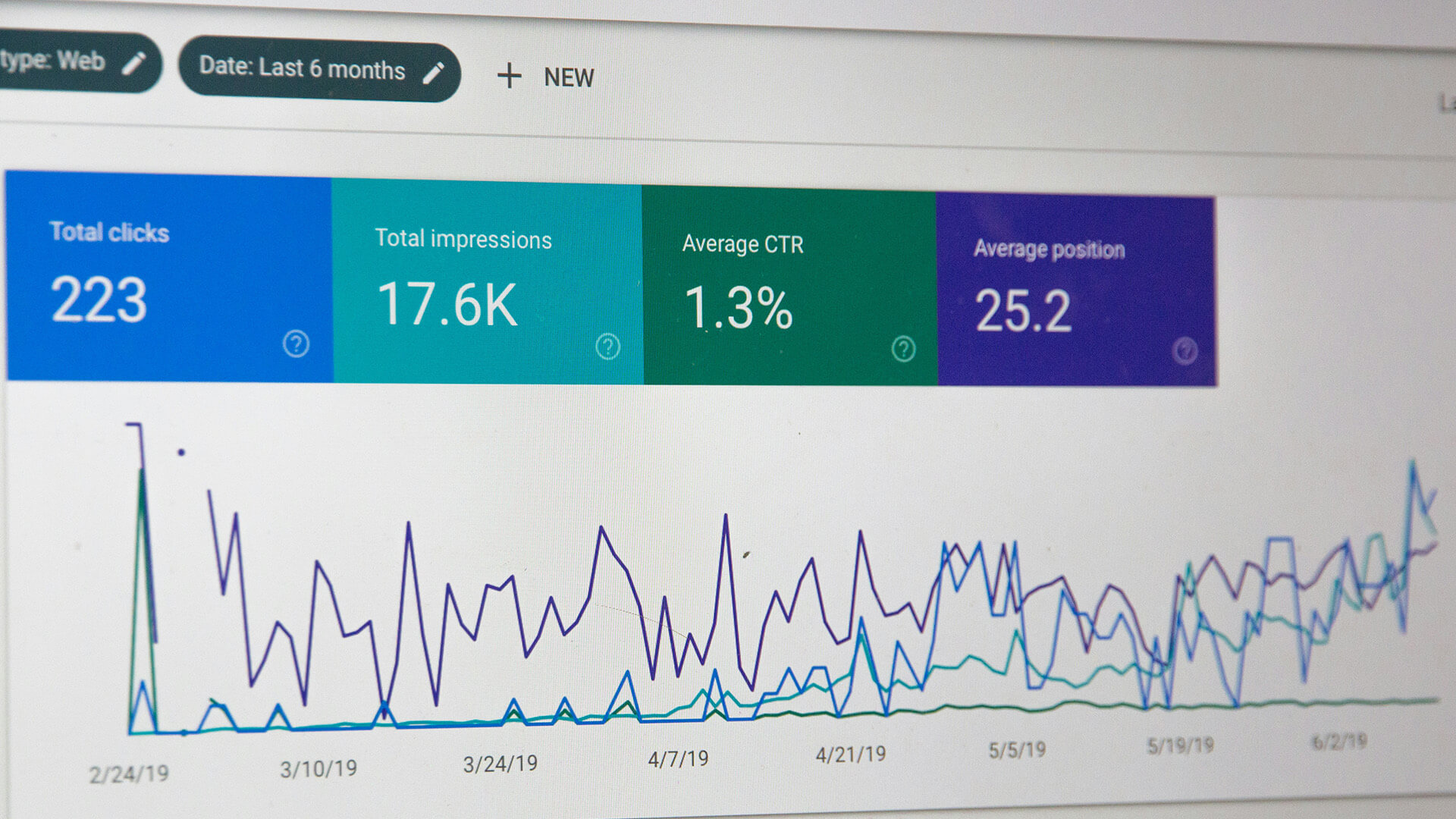

Google My Business Optimisation: Boost Local Visibility & Get More Customers

Learn how to optimise your Google My Business (Google Business Profile) to get found, get clicked, and get customers. Step-by-step tips on improving visibility, building trust, and driving local traffic.

Learn more We’re Hiring: Business Executive

We are seeking a highly motivated, experienced Business Executive to assist in the overall management of the two centres and lead the growth and outreach efforts of Bridge Enterprise Centres.

Learn more Civil Service Travel & Subsistence Rates 2025

Civil service travel and subsistence rates updated Jan 2025. See daily, overnight & motor rates. Ensure tax-free reimbursements meet ERR reporting rules.

Learn more Choosing the Right Office Space Can Make or Break Your Start-up

How location, flexibility, and collaboration impact your early-stage success. Tips on how to choose the right office space for your business.

Learn more €500,000 in Cross-Border Business Awards Now Open for Applications

Stelios Foundation & Co-operation Ireland launch North-South Business Awards 2025. €500k fund for cross-border start-ups. Apply by Sept 16, 2025.

Learn more How to Create a Great Workplace Culture in a Small Business

Small business success starts with strong culture. Learn how to set values, improve communication, and lead your team with purpose from the start.

Learn more ICOB & Power Up Grants: Appeals Process Now Open for Certain Business Sectors

Businesses in the retail, hospitality, and beauty sectors who misclassified during ICOB registration can now appeal and reclassify to access the ICOB and Power Up grants. Appeals close 15 August 2025.

Learn more YOUR VIEWS & OPINIONS REQUIRED ON EMPLOYMENT PERMITS SYSTEM

Have your say on Ireland's 2025 Occupations Lists review. Submit feedback on skills shortages, quotas & labour market needs by 19 Sept. 2025.

Learn more Government Summer Economic Statement

Ireland’s latest budget plans mark a bold shift towards housing and infrastructure investment — but risk undermining environmental goals and long-term fiscal stability.

Learn more How to Structure Staff Bonuses Without Breaking the Bank

Discover how small businesses can implement effective, budget-friendly bonus schemes that motivate staff, boost performance, and support long-term growth.

Learn more Scaling Your Team: When to Hire and How to Get It Right

Hiring is a key part of business growth, but timing and strategy are everything. Learn when to hire, how to define the right role, and how to set your team up for long-term success with expert HR advice and training tips.

Learn more GOOD NEWS FOR SMEs with overdue Changes to Audit Exemption Rules.

From July 16, 2025 changes in the audit exemption regime for companies is to be welcomed as it has become more forgiving for SMEs.

Learn more Cybersecurity & IT Essentials for Small Businesses in Ireland

Discover how small businesses can boost productivity, security, and growth by getting IT basics right. Learn practical, budget-friendly tech tips from Bridge Enterprise Centres.

Learn more BIK on Commercial Vehicles – CAREFUL NOW!

Understand Benefit in Kind (BIK) on commercial vehicles in Ireland, how it's calculated, common misconceptions, exemptions, and ways to minimise BIK liability for your business.

Learn more How to Scale Your Marketing

Scale your marketing smarter, not harder. Discover practical tips on automation, audience targeting, and conversion optimisation from Lissa McPhillips, Strategic Marketing Adviser at Dynamic Marketing.

Learn more Congratulations to the DLR’s newly elected Cathaoirleach & and Leas-Cathaoirleach!

Bridge Enterprise Centres congratulates newly elected Cathaoirleach Cllr Jim Gildea and Leas-Cathaoirleach Cllr Pierce Dargan. We look forward to working together to support enterprise and strengthen communities in west Dún Laoghaire-Rathdown.

Learn more Office Available to Rent – Nutgrove Campus

Bright, flexible layout in a prime business location with excellent transport links. Enquire now via Daft.ie.

Learn more ARE YOU ENTITLED TO GRANTS PREVIOUSLY WITHHELD DUE TO GOVERNMENT ERROR?

Thousands of SMEs may now claim grants wrongly withheld under the 2025 ICOB and Power Up schemes due to a government error. €40M owed—appeals process coming soon.

Learn more Office Available to Rent – Sandyford Campus

Bright, flexible layout in a prime business location with excellent transport links. Enquire now via Daft.ie.

Learn more Webinar: Winning Government Contracts: Using AI & Strategy to Compete Smarter

View our webinar on "Winning Government Contracts: Using AI & Strategy to Compete Smarter", featuring Tony Corrigan from Bidable. We’ll explore how to find the right tender opportunities, decide whether to bid, and use AI to write stronger, more targeted proposals.

Learn more Building Connections: The Importance of Networking for SMEs

Running a business can sometimes feel like going it alone — but it doesn’t have to be. Local networking events are a powerful way to build genuine connections, discover new opportunities, and grow your reputation right where it matters most: in your own community.

Learn more 5 Copywriting Tips to Increase Website Conversions

Discover five simple copywriting changes that help Irish small businesses get more leads, enquiries and sales from their websites.

Learn more How Business Mentoring Can Fast-Track Your Growth

Feeling stuck or stretched running your business? You don’t have to do it alone. Business mentoring helps founders gain clarity, confidence, and focus—whether they’re just starting out or ready to scale.

Learn more Webinar: Unlock Upskilling Opportunities to Transform your Business

View our webinar on "Unlock Upskilling Opportunities to Transform your Business", featuring Natasha Kinsella from Regional Skills Dublin, who will share expert insights and guidance for businesses looking to future-proof their teams.

Learn more Gender Pay Gap Reporting: What It Is and What You Need to Do About It

If your business has 50+ employees, Gender Pay Gap Reporting isn’t just a box to tick — it’s a powerful tool for driving equity and building a stronger workplace culture.

Learn more End of VAT Fixed Direct Debit Scheme

Big changes ahead for VAT payments: Revenue will replace the Fixed Direct Debit scheme with a new Variable Direct Debit system from June 2025. Read all about it here!

Learn more Angel Investing Masterclass – May 6th, 10am

Designed for those new to angel investing, this session will guide you through the essentials—from evaluating start-up pitches to building a smart, strategic investment portfolio.

Learn more Local Business Association Survey

We are conducting this SHORT survey to better understand the needs of our local business community.

Learn more Webinar: Cyber Security Fundamentals for SMEs

Paul Delahunty, Information Security Officer for Stryve presents "Cyber Security Fundamentals for SMEs". This session aims to equip small and medium-sized enterprises with essential knowledge to protect their data and maintain secure operations.

Learn more 5 Common Startup Mistakes & How to Avoid Them

Thinking of starting a business in Ireland? Avoid these 5 common startup mistakes! Many new entrepreneurs face challenges that can be easily avoided with the right preparation. From financial planning to marketing and legal compliance, taking the right steps early on can make all the difference.

Learn more REGISTER TODAY for our upcoming 6-week training programme: Growing Your Digital Presence – A Playbook for Irish SMEs

We are excited to introduce our 6-week training programme, Growing Your Digital Presence: A Playbook for Irish SMEs. Designed specifically for small business owners, this programme will help you develop essential digital skills to enhance your business’s online presence and growth. This training programme is part-funded by the centre, so total cost to you is €100!

Learn more Secure Your Business’s Future with the 2025 SME Fund

As a business owner, you’ve worked hard to build something valuable—so why leave it unprotected? The 2025 SME Fund, launched by the European Commission and EUIPO, is here to help SMEs like yours cover the costs of patents, trademarks, and designs—with grants of up to €1,500 available!

Learn more How to Take Your Business from Idea to Reality – A Step-by-Step Guide for Startups

Starting a business is an exciting journey, but it takes careful planning and strategy to make it a success. From refining your idea and securing funding to building a brand and launching your business, our latest blog walks you through the essential steps to get started.

Learn more Looking Back at Local Enterprise Week 2025

From boosting sales and personalised business advice to the power of AI for business growth - here is our Local Enterprise Week round-up!

Learn more Webinar – How AI Can Drive Business Growth

Richard McKeown, a top marketing strategist with WSI will share practical AI applications to help grow your business.

Learn more Webinar: 5 Steps to Boost Sales

Lissa McPhillips from Dynamic Marketing discusses a practical 5-Step Action Plan to supercharge your sales and achieve your revenue goals.

Learn more Enhanced Revenue Reporting – How to stay compliant!

Revenue is ramping up compliance checks to detect under-reporting, enforce accurate tax filings, and ensure transparency. To stay compliant, businesses must update payroll systems, train staff, and verify tax deductions—or risk penalties and audits.

Learn more Webinar: Business/Grant Supports and Finance Options for Businesses

Expert speakers from Enterprise Ireland, Dun Laoghaire-Rathdown Local Enterprise Office and Micro Finance Ireland, who provide valuable insights and tips on supports available, how to secure grants and navigate financing options.

Learn more Work-Life Balance for Small Business Owners: Tips to Avoid Burnout

Running a small business is rewarding but demanding—without balance, burnout is inevitable. Here are some practical tips to help Irish entrepreneurs stay productive without sacrificing well-being.

Learn more How to Pitch Your Business Idea – Tips for Making a Compelling Pitch

Want to make your business pitch stand out? Whether you're seeking investment, a partnership, or new clients, a compelling pitch is key to success. Check out these top tips to craft a persuasive and impactful presentation!

Learn more Auto-Enrolment Pensions in Ireland with Lynx Financial Services

The Auto-Enrolment (A-E) pension scheme is set to launch in September 2025, bringing major changes for small business owners and self-employed individuals. Employers must enrol eligible employees, with contributions coming from workers, employers, and the government. This guide breaks down how A-E works, who is affected, and what businesses need to prepare for.

Learn more Employment Law Changes in 2025 with Voltedge Management

As 2025 approaches, Irish businesses face a range of important employment law updates that will shape workplace practices and compliance. From the introduction of the Auto-Enrolment Retirement Savings Scheme to the expansion of gender pay gap reporting, these changes bring new responsibilities and opportunities.

Learn more The Importance of Networking: How to Build Meaningful Connections

Building strong professional connections is essential for business success in Ireland. Networking isn’t just about making contacts—it’s about fostering meaningful relationships that create opportunities, support, and growth.

Learn more Leveraging eCollege to Upskill Your Workforce

Upskilling your workforce is essential for staying competitive in today’s business environment. eCollege, Ireland’s national online learning platform, offers businesses flexible, government-funded courses across a wide range of disciplines. From IT and digital marketing to project management, discover how eCollege can empower your team and drive success.

Learn more What Should Your Business Do During a Red Weather Warning?

Here are the steps your business should take when Met Éireann issue a Status Red weather warning!

Learn more Staying Productive in a Shared Workspace: Strategies for Focus and Efficiency

Sharing an office with colleagues from the same company can be both exciting and challenging. It’s a space where teamwork flourishes, ideas flow, and collaboration thrives—but it also demands strategies to stay focused and productive.

Learn more Key Insights for Start-ups and SME Owners from the Draft Programme for Government 2025

The Draft Programme for Government 2025 sets out a bold vision for Ireland’s economic future, with a strong focus on supporting SMEs. Key measures include pro-enterprise tax policies, enhanced access to funding, and reforms to reduce costs and bureaucracy. Here’s what you need to know.

Learn more Essential Tech Tools for Irish Startups

Starting a business in Ireland requires the right tools to stay efficient, compliant, and competitive. From productivity apps to accounting software and marketing solutions, technology can be a game-changer. This guide explores essential tools available to help your startup thrive.

Learn more January Self-Care Checklist: Daily Practices for a Healthier You

From staying hydrated and prioritising sleep to practising gratitude and nurturing relationships, we outline simple yet effective ways to care for your body, mind, and spirit. By incorporating these practices, you can set a positive tone for the year ahead.

Learn more End of Year Message from the Bridge Enterprise Centres’ Chair.

As 2024 draws to a close, Bridge Enterprise Centres’ Chair, Mark Fielding, reflects on the year’s challenges and achievements for SMEs. Despite rising costs and squeezed profit margins, small business owners have shown resilience, optimism, and a commitment to innovation and growth.

Learn more A Simple Guide to SEO for Irish Small Businesses

Boost your online visibility with this straightforward guide to SEO tailored for Irish small businesses. Learn how to attract local customers, optimise your website, and avoid common mistakes to stand out in search engine results.

Learn more End of Year Financial Planning

As Christmas approaches once again, it’s a great time to reflect on your financial planning for the year ahead. With 2025 likely to fly by just as quickly, small changes now can make a big difference to your financial wellbeing. Here are some simple tips to help you start the new year on the right track.

Learn more Mediation Service Launched for Motor Liability Claims

The Injuries Resolution Board has launched mediation services for motor liability personal injury claims, extending its existing offerings for employer and public liability cases. This expansion supports faster, cost-effective claim resolutions as part of the Government’s "Action Plan for Insurance Reform."

Learn more Tax-Efficient Ways You Can Reward Your Employees This Festive Season

With the festive season upon us, you have a great opportunity to show appreciation to your employees for their hard work. From the updated Small Benefit Exemption Scheme to hosting morale-boosting events, there are plenty of compliant, tax-efficient ways to give back.

Learn more Preparing Your Business for the Festive Season: A Practical Checklist

The festive season is a time of celebration and reflection, but for businesses, it also requires a bit of planning. From customer communication to organising internal affairs, preparing thoroughly ensures a smooth and stress-free break.

Learn more Check Out Our November Newsletter!

We're excited to share the latest updates and insights from Bridge Enterprise Centres in our November newsletter! This month, we’re featuring our new after-hours services tailored to fit your busy schedules, practical tips to help your business thrive during the holiday season, and an inspiring Member Spotlight showcasing one of our incredible local entrepreneurs.

Learn more Year-End Checklist: Preparing For Your Audit – A Guide For SMEs

As the year draws to a close, small and medium-sized enterprises (SMEs) across Ireland are gearing up to close their books and prepare for the possibility of an audit. For Irish SMEs, audits are not just a statutory obligation but an opportunity to showcase financial transparency and build trust with stakeholders. To help your business prepare, we’ve outlined a comprehensive year-end checklist to make the audit process smoother and less stressful.

Learn more Preparing for 2025: A Talent-Focused Approach with Voltedge Management

With 2025 on the horizon, aligning talent strategies with evolving business needs is essential. Retaining and developing employees is key to driving growth and staying competitive. Prioritising learning and inclusion today builds success for tomorrow.

Learn more Grow Digital: Helping Your Business Thrive

Grow Digital is an online platform designed to help businesses embrace digital transformation. It offers resources like a tailored survey that generates a personalised report with practical advice, funding guidance, and links to relevant supports. This tool empowers businesses to develop digital strategies, upskill teams, and stay competitive in a rapidly evolving marketplace.

Learn more Final Call: Trading Online Voucher Scheme Closing Soon!

Grants of up to €2,500 are available to help micro-enterprises boost their online presence. The deadline is 5 PM on Friday, 13th December 2024—submit your application today!

Learn more Performing a Cyber Security Audit and Establishing a Policy

In today’s digital landscape, even small businesses face significant cyber threats. This article provides a straightforward template, covering essential security practices like access control, data protection, device security, and employee training for a safer business environment.

Learn more New Service – After Hour Meeting Room Hire

Bridge Enterprise Centres now offers an After Hours Service for meeting room rentals in the evenings and weekends, with options to suit every need. Choose from concierge-assisted openings, full-service open & closing, or independent access. Enjoy flexibility, security, and a professional setting beyond business hours!

Learn more Have you applied for your Power Up grant of €4,000?

In Budget 2025, the Government announced a new grant of €4,000 called Power Up, to assist businesses in hospitality, retail and beauty sectors. Closing date is November 8th 2024.

Learn more Thoughts about the Budget and other Financial Topics by Lewis & Co Chartered Accountants

Three weeks after Budget 2025, Ben Lewis & Co. Chartered Accountants highlight key updates. Couples earning €50,000 could save €2,382 in 2025, with pension contributions offering extra benefits. Electric cars remain a top tax-saving option for businesses, and new PRSA pension limits take effect in 2025. Autoenrolment begins in September, and the small gift exemption rises to €1,500.

Learn more Seasonal Marketing Campaigns: A Guide for Irish Businesses

Seasonal marketing aligns promotions with holidays and events to engage customers and boost sales. Campaigns like Spotify Wrapped, timed for year-end, tap into predictable consumer behavior. By planning ahead, setting clear goals, and using digital strategies like content and social media marketing, businesses can create impactful campaigns that drive results.

Learn more Bridge Enterprise Centres welcomes ‘Think Small First’ initiative

The Irish government has approved enhancements to the SME Test, ensuring new legislation considers its impact on small businesses. Bridge Enterprise Centres welcomed the move, with Chairperson Mark Fielding highlighting its importance for reducing red tape and supporting local SMEs.

Learn more Key Policies for Success: Building a Foundation for Sustainable Growth

Establishing essential policies is critical to running a compliant, efficient, and sustainable business. These policies not only provide a clear framework for your daily operations but also help ensure adherence to Irish laws and foster a productive working environment. Below are some of the key policies you should have in place.

Learn more Kickstart Your Energy Efficiency Journey: An Energy Guide for Small Businesses in Dun Laoghaire Rathdown

Gavin Harte is the Dun Laoghaire Rathdown (dlr) SEAI Sustainable Energy Community mentor, supporting 28 DLR communities on their energy journeys. He provides guidance through his 'common sense' steps for energy efficiency. Over 900 communities in Ireland collaborate through the SEC programme, focusing on energy projects across homes, transport, businesses, and community buildings.

Learn more Byrne & McCall’s Comprehensive Budget Summary

Byrne & McCall have released a Budget 2025 guide, detailing key tax measures announced on 1 October 2024. Highlights include adjustments to income tax bands, USC rate reductions, and updates on property and corporate taxation.

Learn more Reaction to BUDGET ’25.

Budget 2025 offers €10.5 billion in measures, including energy credits, VAT reductions, and childcare support. Households benefit from wage increases, tax cuts, and social payments. However, business relief is limited, with calls for stronger pro-growth initiatives.

Learn more Employer and Employee PRSI – Increased Rates from 1st October 2024

Significant changes to the Pay-Related Social Insurance (PRSI) system in Ireland are set to take effect on 1 October 2024. There are adjustments to PRSI rates for both employees and employers across various classes, as well as modifications to self-employed contributions.

Learn more How to Create a Disaster Recovery Plan for Your Business

A disaster recovery plan is essential for ensuring your business can quickly recover from unexpected disruptions like cyberattacks or natural disasters. Here's how to create an effective plan to minimise downtime and protect your operations.

Learn more Creating a Sales Strategy: A Comprehensive Guide for Irish Businesses

Learn how to create an effective sales strategy with this comprehensive guide for Irish businesses. Discover key steps, from setting clear goals to identifying your target audience, building a strong sales team, and continuously improving your approach to drive long-term success.

Learn more Key HR Reports Every Irish Business Should Maintain

Discover the key HR reports every Irish business needs to stay compliant, boost performance, and enhance employee management, from payroll to health and safety.

Learn more Maximising Your Company LinkedIn Profile

A well-optimised LinkedIn profile is essential for businesses looking to enhance their visibility, attract talent, and connect with customers. Whether you’re a start-up or a seasoned company, making the most of LinkedIn can significantly boost your brand’s presence and credibility. Here’s a guide to maximising your company’s LinkedIn profile for success.

Learn more How to Audit the SEO of Your Website and Improve It: A Practical Guide

Conducting an SEO audit is essential to improving your website’s visibility on search engines. This guide outlines how to analyse technical, on-page, and off-page SEO, and provides a framework for ongoing optimisation.

Learn more Government signalling more cost to Irish businesses in 2025

The Irish government is signalling additional costs are on the way for small businesses in 2025, following the Low Pay Commission's recommendation to raise the minimum wage by €1. This would see the minimum wage rise to €13.70 per hour!

Learn more Social Media Tips for Your Business

Social media is a vital tool for businesses seeking to connect with customers and drive growth. However, success requires more than just a presence—it demands a strategic approach tailored to your audience and goals.

Learn more Why It’s Crucial to Keep Your Employee Handbook Up to Date

Regularly updating your employee handbook is essential for legal compliance and clear communication of company policies, ensuring a well-informed and cohesive workforce. It reflects organisational changes and promotes consistency, fairness, and employee empowerment.

Learn more Energy Efficiency Grant Increased For Businesses

The LEO Energy Efficiency grant has increased and now supports the investment in technologies and equipment with 75% of eligible costs up to a maximum grant of €10,000.

Learn more Your Responsibilities to Account for Tax on Share-Based Remuneration to Staff

Share-based remuneration is vital for aligning employee and company interests, with recent legislative updates enhancing tax compliance. The Finance Act 2023 mandates real-time reporting and clarifies tax obligations for improved accuracy and transparency.

Learn more Revenue Commissioners want to know how close you are to your relatives!!

Are you receiving loans from close relatives? Starting January 1st, 2024, there is a new reporting obligation for Capital Acquisitions Tax (CAT). This applies to loans made on or after this date, as well as existing loans, and affects recipients regardless of whether tax is due.

Learn more Can you benefit from recent Company Size Thresholds Increases?

Starting from 1 July 2024, the EU has updated size thresholds for companies, increasing balance sheet and turnover limits by 25% to account for inflation. This adjustment will help many Irish companies qualify as "micro" or "small," allowing them to benefit from simpler reporting and audit exemptions, thereby reducing their regulatory burden.

Learn more The Food Starter Programme – Sept 2nd 2024

The Food Starter Programme is a short, blended course consisting of one full day and two half days. It covers everything from the Irish food sector overview to the specifics of starting a food production business, helping participants avoid common pitfalls.

Learn more Upcoming Changes In Irish Legislation – The Impact To Your Business And How To Stay Compliant

Ireland is set to implement a series of transformative legislative measures that will significantly impact small and medium-sized enterprises (SMEs). We've outlined a brief summary of changes and the supports available to help you remain compliant.

Learn more The Small Companies Administrative Rescue Process (SCARP) – Everything you need to know, and when you should avail of it.

The Irish Small Companies Administrative Rescue Process (SCARP) is a legal framework established to aid small and micro companies in Ireland experiencing financial difficulties.

Learn more Irish SMEs Scammed out of almost €10m in 2023

Irish SMEs lost almost €10 million to email scams last year, with incidents rising by 25%, according to FraudSmart. Most scams involved fake invoice redirections where fraudsters posed as known suppliers and provided bogus bank details.

Learn more Navigating Ireland’s Changing Employment Laws: The Implications For Your Business

Discover the recent changes in Ireland's employment laws, including statutory sick pay, gender pay gap reporting, expanded parental leave, remote working rights, and more. Learn how these updates impact employers and employees, promoting a fairer and more supportive work environment.

Learn more The Importance of Good Board Governance

Good board governance is crucial for organisational success, ensuring transparency, accountability, strategic oversight, and ethical leadership.

Learn more First Aid Requirements for Irish Businesses: Ensuring Safety and Compliance

Irish businesses must comply with first aid requirements set by the Health and Safety Authority (HSA). Employers must conduct risk assessments to determine necessary first aid measures, including trained personnel and appropriate equipment.

Learn more Charge Into Summer EV Event

Join our members, DC EC, at their The Electric Circle – Dublin event to explore the future of driving through e-mobility.

Learn more Energy Grants for SMEs

The Sustainable Energy Authority of Ireland (SEAI) offers a range of financial supports to help small and medium businesses (SMEs) invest in energy-saving technologies. These supports include grants for energy-efficient products, renewable heat systems, and electric commercial vehicles.

Learn more Important changes to the categorisation of Irish Companies

This change means more companies will fall into the micro and small categories, allowing them to take advantage of simplified reporting requirements and audit exemptions.

Learn more Bridge Enterprise Centres endowment recipients win major award

Congratulations to St. Kieran's National School in Bray for winning the Curious Minds Platinum Award in 2024. The Platinum is the highest award possible, recognizing outstanding achievements and dedication to fostering curiosity and learning.

Learn more Work permit holders update

The Employment Permits Bill 2022, set to pass through the Oireachtas, will enable work permit holders in Ireland to change employers after nine months.

Learn more LinkedIn for B2B Marketing

Join us at Bridge Enterprise Centres on June 26th at 9:30 am for an insightful presentation by Richard McKeown on leveraging LinkedIn for B2B marketing.

Learn more Artificial Intelligence and Microsoft Technology

Microsoft has introduced a new category of AI-enhanced personal computers called "Copilot+," which can handle AI tasks directly on the device, enhancing functionality and performance without relying on cloud data centers.

Learn more Meeting Room Facilities at Bridge

Looking for the perfect meeting space? Bridge Enterprise Centres offer newly refurbished, modern, fully-equipped meeting rooms designed to inspire productivity.

Learn more Inspiring Women Entrepreneurs 2024: A Launch Event for Female Chartered Accountants

Chartered Accountants Ireland is hosting an event, "Inspiring Women Entrepreneurs 2024," on June 26th from 6-8pm at Chartered Accountants House, Dublin.

Learn more Exciting June Events at Bridge Enterprise Centres

This month, Bridge Enterprise Centres is hosting two fantastic events designed to help businesses grow and succeed in the digital age. Whether you're looking to boost your B2B leads using LinkedIn or maximize your website for brand success, we've got you covered. Mark your calendars and join us for these informative sessions led by industry experts.

Learn more Survey shows one third of SMEs would close within 6 months without funding

Just over a third of small and medium sized enterprises (SMEs) here say they would go out of business within six months if they did not get additional funding, a new survey has found.

Learn more The Bridge Enterprise Centres May Newsletter is LIVE!

In this edition of the Bridge Enterprise Centres Newsletter we provide important updates on various grants and new supports for SMEs. We cover recent tax changes affecting employee expenses, enhanced reporting requirements, and updates on the Debt Warehousing Scheme.

Learn more Lynx Financial Services – Auto-enrolment

Pension Auto-Enrolment, a significant new initiative, is set to bring 800,000 workers into a retirement savings scheme by Q1 2025. This article by Gareth Watkins of Lynx Financial Services outlines the key details and implications for both employers and employees.

Learn more 12 Startups Complete Prep4Seed Programme for Seed Investment

The participating startups, spanning sectors such as Industrial, Life Sciences, FinTech, Food, and ICT, are collectively seeking over €14.6 million in investment.

Learn more Revenue’s Tax Status Guidelines – Post Domino’s Case

Revenue has issued fresh guidelines on determining the employment status of workers for tax purposes, following a recent landmark Supreme Court ruling concerning Domino's Pizza delivery drivers.

Learn more EU Enacts Groundbreaking AI Regulation

European Union policymakers have endorsed the world's first comprehensive AI regulation, covering tools like ChatGPT and biometric surveillance, set to take effect next month.

Learn more Revenue Concerns of Pension Tax Loophole

The Revenue Commissioners have contacted the Department of Finance to express concerns over what the Opposition is calling a "massive loophole" that allows individuals to invest up to €2 million tax-free into their pension funds.

Learn more You can now record advance payments on ROS – ERR Reporting Update

Revenue has introduced a new facility on the Revenue Online Service (ROS) to record advance payments for employee travel and subsistence expenses.

Learn more Improved grants and schemes to help SMEs overcome rising costs

The Minister for Enterprise, Trade and Employment Peter Burke, has announced several measures to support small and medium-sized businesses (SMEs) in response to rising costs

Learn more Update on the Debt Warehousing Scheme

Revenue has made significant progress in reducing the debt within the warehouse, with nearly 90% of the €1.65 billion debt either paid off, secured in phased payment arrangements, or included in proposed plans.

Learn more Government announces changes to Employment Permits

The Irish government has announced significant changes to employment permits aimed at streamlining the process for both employers and applicants.

Learn more Retail & Hospitality SMEs to get grants of up to €5,000

The introduction of a €5,000 grant under the Increased Cost of Business scheme by the Irish government signifies a targeted effort to support small and medium businesses in the retail and hospitality sectors.

Learn more Revenue Changes on Employee Expense and Benefits Disclosures

Discover the latest Revenue regulations: Section 897C requires employers to report employee expenses and benefits from January 1, 2024. How to stay compliant!

Learn more Office Available To Rent – Nutgrove Campus

Exciting News! An office has become available to rent at the Bridge Enterprise Centre's Nutgrove Campus.

Area: 25 sqm/273 sqft. Facilities include: Ample Parking, 24/7 Access, Access to Meeting Rooms,

Learn more Deadline for Increased Cost of Business grant fast approaching!

A reminder that the deadline for Increased Cost of Business (ICOB) grant registration is fast approaching! Businesses have until 1st May to register on the ICOB Portal at www.icob.ie

Learn more Business insurance premiums are up despite a fall in settlement costs

2022 saw a rise in Irish business insurance premiums despite lower settlement costs. Discover the Central Bank's insights and future expectations.

Learn more A busy workshop week at Bridge Enterprise Centres – March 4th to 8th

We had a very busy and active workshop week at Bridge Enterprise Centres to mark Local Enterprise Week.

Learn more Important update for Bank of Ireland app users

Bank of Ireland app users run risk of losing access. Check if you are at risk?

Learn more Revenue warns businesses over upcoming warehoused debt deadline

Revenue issues warning on warehoused debt. Engage now, or risk paying onerous interest rates on the balance.

Learn more Irish firms see gender pay gap narrow slightly

The gender pay gap among larger Irish firms narrowed from 12.6% in 2022 to 11.2% last year.

Learn more Increased Cost of Business (ICOB) Grant Announced

The government has announced a new Increased Cost of Business (ICOB) Grant for small & medium businesses!

Learn more Bridge Enterprise Centres: A Network of Support for Dún Laoghaire-Rathdown’s Local Economy

Merger of Nutgrove and St. Kieran's Enterprise Centres creates a vibrant local business nexus.

Learn more Event: Mastering the sales journey

Friday 8th March, 10am to 12.00pm by Jo Collins - Sales Performance

Learn more Event: Pensions, Savings and Investing

Thursday 7th March, 9.30am to 10.30am by Gareth Watkins (QFA SIA) - Lynx Financial Services

Learn more Event: Using SEO to drive business growth

Wednesday 6th March, 10.30am to 11.30am by Jarlath Moloney from Giant Elk Creative

Learn more Event: Digital Marketing and AI

Wednesday 6th March, 9.30am to 10.30am by Richard McKeown - Digital Marketing Strategist and Consultant with WSI McKeown

Learn more Event: HR & Employment Law

Tuesday 5th March, 9.30am to 10.30am by Liz O'Donovan, Senior HR Business Consultant at Voltedge Management

Learn more Event: Strategy and Planning in Action

Monday 4th March, 9.30am to 11.30am by Geraldine Lavin, Director, 3rd i Ltd

Learn more Online Scammers Are More Sophisticated Than Ever

The challenges caused by modern online scammers, and how to avoid them

Learn more What to know about Pensions in 2024

With recent changes to pension rules, here are some key facts to know from January 2024

Learn more Business Planning – Why bother?

What are the benefits of business planning and why should you engage with it

Learn more Make 2024 the year of the BEHAG for your business

Start your buisness plan now and grow your business in 2024

Learn more Payroll Enhanced Reporting From Jan 2024

Recent changes to payroll submission around tax-free payments, small benefits and remote working allowances

Learn more St. Kierans Enterprise Centre and Nutgrove Community Enterprise Park merge to form Bridge Enterprise Centres

Welcome to Bridge Enterprise Centres!

Learn more Minister Coveney announces €257m in Grants to help meet Increased Cost of Business

A new grant announced by the Government to help small businesses with the increased cost of business

Learn more Common mistakes businesses are making in GA4

Some common mistakes and insights for using GA4 for your business insights

Learn more Budget 2024 – What You Need To Know

Get ready to navigate the fiscal landscape with our concise summary of the key Budget 2024 points

Learn more How to Manage A Hot Desk Workplace

Find the perfect hot desk for improved productivity & follow these strategies for efficient management

Learn more €400K investment for your Start-Up. Investment decision by Dec 8th

A recent €400K investment announced for start-ups, with Investment decision by Dec 8th

Learn more Helping to make SMEs smarter, leaner and greener.

A recent article from the Irish Independent highlights some new supports to help make SMEs smarter leaner and greener

Learn more